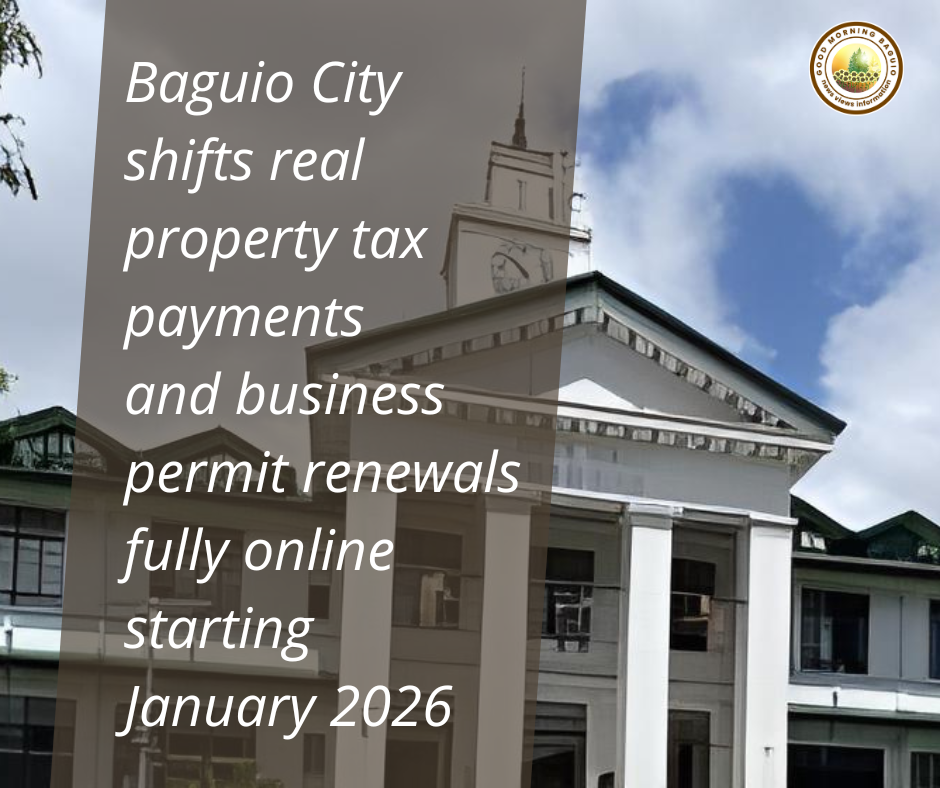

Baguio shifts RPT, business permits fully online in 2026

BAGUIO CITY — City Treasurer Alex Cabarrubias announced that the issuance, processing, and payment of real property tax (RPT) and business permits in Baguio City will shift fully online beginning January 2026, as part of the city government’s transition to digital systems.

In a public advisory, Cabarrubias said that Real Property Tax bills and statements are now available through the city’s Electronic Business Permits and Licensing System (eBPLS) at ebpls.baguio.gov.ph, where property owners and business taxpayers can request and download their statements by following the site’s instructions.

Starting January 2, 2026, all assessments for the renewal of business permits will also be accessible exclusively through the same online portal.

Cabarrubias stressed that City Hall will no longer issue printed business tax assessments or real property tax statements, making online access mandatory for taxpayers.

Only taxpayers who are unable to generate their documents online due to system issues, such as receiving a “No Record Found” notice, will be accommodated at the Treasury Office.

Affected taxpayers must present a screenshot of the error message and submit supporting documents, including income tax returns, audited financial statements, and other proof of gross receipts for the years 2023 to 2025.

To manage the expected volume of renewals and prevent overcrowding at the One-Stop Shop, the city will enforce a strict month-by-month schedule for business permit renewals based on the business owner’s family name or corporate name.

Business owners with names beginning with letters A to H are scheduled from January 2 to 31, those with names starting I to P from February 1 to 28, and Q to Z, as well as names beginning with numbers or special characters, from March 1 to 20.

Cabarrubias emphasized that business owners who attempt to renew permits outside their designated month will not be entertained.

He added that failure to renew within the assigned period will result in penalties computed from January 1, 2025.

However, businesses with scheduled bidding activities in January, February, or March whose assigned renewal month falls outside these periods may be accommodated, provided they present an Invitation to Bid and proof of payment for bid documents.

Payment of real property tax will remain open to all taxpayers regardless of schedule, although Cabarrubias cautioned the public to expect long queues at City Hall.

To avoid delays, taxpayers were encouraged to use online payment options through the eBPLS portal, inter-bank deposits or transfers, and check payments.

For inter-bank payments, taxpayers may deposit or transfer funds to Land Bank Account No. 0222-0015-95 under the account name City Government of Baguio.

Proof of deposit or transfer must be emailed to cto.baguio@gmail.com, with official receipts or permit printing available after at least five working days.

Payments may also be made via manager’s or cashier’s check payable to City Treasurer – Baguio City, mailed or delivered to the Treasury Office at City Hall, Baguio City 2600.

Taxpayers are required to include or email complete details of the property or business being paid for.

Cabarrubias appealed for the cooperation and understanding of the public as the city transitions to a more efficient digital system, urging taxpayers to maximize online services to save time and reduce foot traffic at City Hall.

Share

Related Articles

Recent Posts

- Cordillera regional sports meet opens in Benguet

- BYD Sealion 5 taxi fleet debuts in Cordillera

- SM City Baguio welcomes Lunar New Year

- 30,000 attend Philippine International Hot Air Balloon Fiesta in Clark

- Cordillera police seize P22.7M drugs, arrest 20 in February crackdown

Sections

- Accidents & Emergencies

- Ads & Marketing

- Agriculture

- Anniversaries

- Awards & Recognition

- Baguio's Embrace

- Banking

- Barangay Affairs

- Bazaars

- Business & Economy

- Calligraphy

- Celebrities

- Commercial Developments

- Community Hub

- Concerts

- Consumer Affairs & Entrepreneurship

- Corporate

- Corporate Social REsponsibility

- Creative Economy

- Cycling

- Digital Arts

- Diplomacy & Official Visits

- Diversity & Inclusion

- Education & Youth

- Entertainment

- Environment & Sustainability

- Esports & Streaming

- Events

- Fashion & Beauty

- Festivals

- Film & Media Arts

- Food & Dining

- Golf

- Governance & Policy

- Government & Public Assets

- Health & Wellness

- Holiday Events

- Home & Interior Design

- Indigenous Peoples Affairs

- Infrastructure

- Inspirations

- Jobs & Employment

- Law Enforcement

- Leadership & Appointments

- Legal Affairs

- Legislation

- Literature

- Local Government

- Local Heritage

- Martial Arts

- Milestones

- Mining

- Movies

- Olympics

- Pageants

- People & Personalities

- Performing Arts

- Pertempto

- Poetry

- Politics

- Power & Energy

- Promotions

- Public Health

- Public Safety & Security

- Public Welfare

- Real Estate

- Regional Updates

- Scripture

- Sports

- Technology & Digital Services

- Telecommunications & Digital Policy

- Tennis

- Theatre & Musicals

- Traffic & Transport

- Tributes

- Trustworthy Road

- Urban Development

- Visual Arts

- Weekly Horoscope

- World