SSS offers Conso Loan program, waives penalties

The Social Security System (SSS) has launched the Consolidation of Past Due Short-Term Member Loans with Condonation of Penalty (Conso Loan) program.

This initiative aims to assist members with past-due loans in regaining their good standing with the SSS.

In a recent statement released by SSS, Rizaldy T. Capulong, SSS Executive Vice President for Investments Sector, explained that the Conso Loan program consolidates the principal and interest of a member’s past-due short-term member loans into one loan.

All unpaid penalties will be waived upon full payment of the consolidated loan.

Members with outstanding obligations in salary, calamity, emergency, and restructured loans, including the Salary Loan Early Renewal Program (SLERP), are eligible for the program.

Capulong encouraged members to take advantage of this opportunity to settle their past-due loans without penalties through an easy payment scheme.

To qualify for the program, members must:

- Have a past-due short-term member loan at the time of application

- Not have been granted any final benefit such as permanent total disability or retirement

- Not have been disqualified due to fraud committed against the SSS

- Have an active My.SSS account

Applications for the Conso Loan program can be submitted online through the My.SSS account.

Members can choose to pay their consolidated loan through a one-time payment within 30 calendar days after receiving the approval notice or opt to pay through installment.

For the installment scheme, members must pay a down payment equivalent to at least 10% of the consolidated loan within 30 calendar days after receiving the approval notice.

The remaining balance can be paid for up to 60 months, with the length of the installment term depending on the amount of the unpaid loan.

Capulong noted that if a member fails to meet the payment terms based on the consolidated loan agreement, SSS will deduct the outstanding balance of the consolidated loan from the short-term benefits (sickness, maternity, or partial disability benefit claims) and final benefits (permanent total disability, death, retirement), as authorized by the Social Security Commission (SSC).

As of December 2023, more than half a million members have availed of the Conso Loan program, and SSS has already condoned more than P7.3 billion loan penalties, the statement said.

Share

Recent Posts

- Benguet opens 2026 Coffee-Cacao Quality tilt

- Cordillera regional sports meet opens in Benguet

- BYD Sealion 5 taxi fleet debuts in Cordillera

- SM City Baguio welcomes Lunar New Year

- 30,000 attend Philippine International Hot Air Balloon Fiesta in Clark

Sections

- Accidents & Emergencies

- Ads & Marketing

- Agriculture

- Anniversaries

- Awards & Recognition

- Baguio's Embrace

- Banking

- Barangay Affairs

- Bazaars

- Business & Economy

- Calligraphy

- Celebrities

- Commercial Developments

- Community Hub

- Concerts

- Consumer Affairs & Entrepreneurship

- Corporate

- Corporate Social REsponsibility

- Creative Economy

- Cycling

- Digital Arts

- Diplomacy & Official Visits

- Diversity & Inclusion

- Education & Youth

- Entertainment

- Environment & Sustainability

- Esports & Streaming

- Events

- Fashion & Beauty

- Festivals

- Film & Media Arts

- Food & Dining

- Golf

- Governance & Policy

- Government & Public Assets

- Health & Wellness

- Holiday Events

- Home & Interior Design

- Indigenous Peoples Affairs

- Infrastructure

- Inspirations

- Jobs & Employment

- Law Enforcement

- Leadership & Appointments

- Legal Affairs

- Legislation

- Literature

- Local Government

- Local Heritage

- Martial Arts

- Milestones

- Mining

- Movies

- Olympics

- Pageants

- People & Personalities

- Performing Arts

- Pertempto

- Poetry

- Politics

- Power & Energy

- Promotions

- Public Health

- Public Safety & Security

- Public Welfare

- Real Estate

- Regional Updates

- Scripture

- Sports

- Technology & Digital Services

- Telecommunications & Digital Policy

- Tennis

- Theatre & Musicals

- Traffic & Transport

- Tributes

- Trustworthy Road

- Urban Development

- Visual Arts

- Weekly Horoscope

- World

Related Articles

SSS Baguio tags ten delinquent employers, resumes RACE Campaign

During its Run After Contribution Evaders Campaign on Jan 31, SSS Baguio mandated non-compliant employers to rectify their outstanding dues. … Read More >SSS Baguio tags ten delinquent employers, resumes RACE Campaign

SSS revenue in 2023 surpasses target by 9.5 percent

The SSS announced that its 2023 revenue surpassed target by 9.5 percent, from P330.80 billion to P362.20 billion … Read More >SSS revenue in 2023 surpasses target by 9.5 percent

SSS retiree-pensioners encouraged to avail low-interest Pension Loan Program

SSS is calling on its retiree-pensioners to take advantage of its low-interest Pension Loan Program for their immediate financial needs. … Read More >SSS retiree-pensioners encouraged to avail low-interest Pension Loan Program

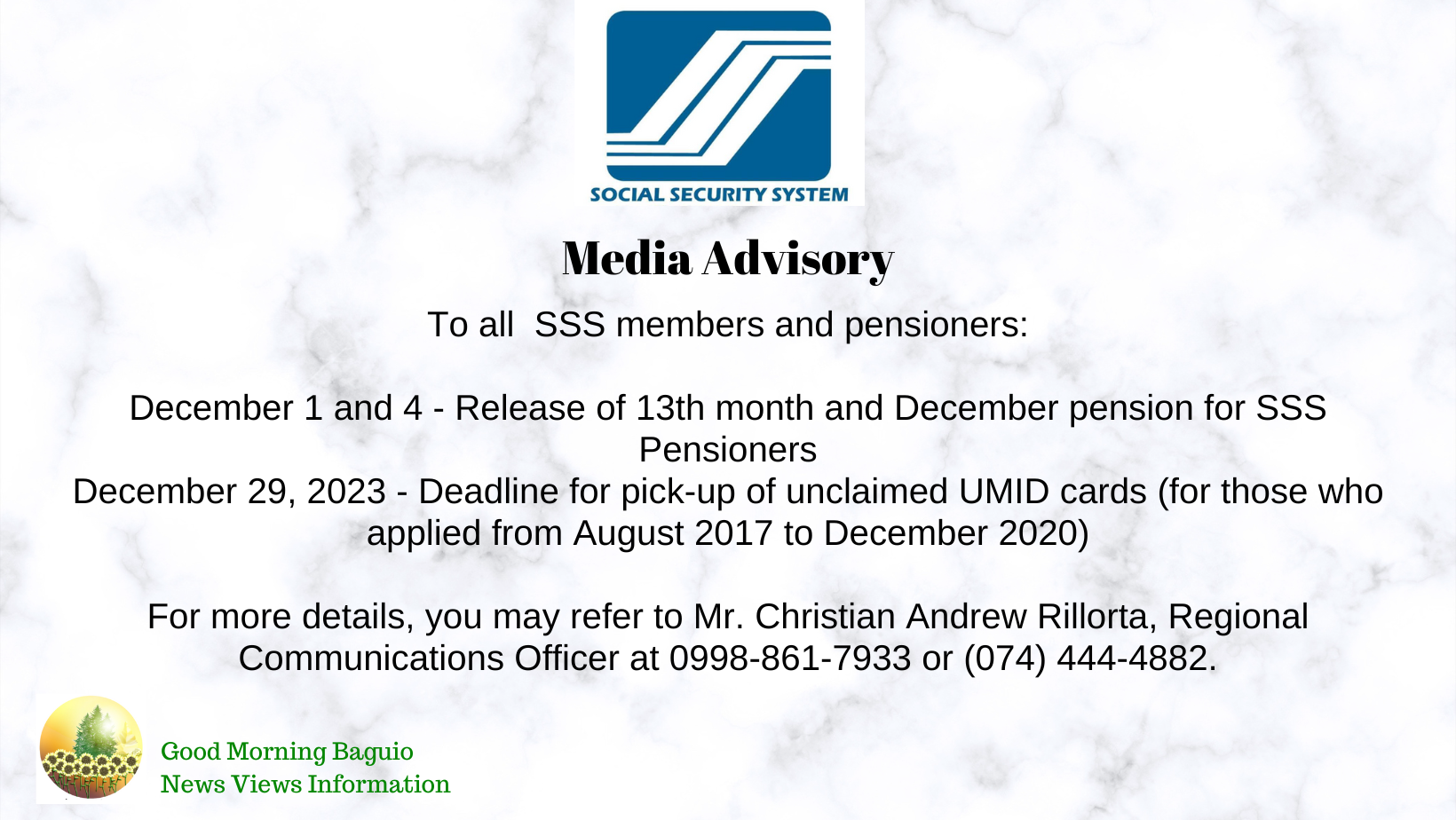

SSS Media Advisory

SSS media advisory regarding schedule of release of SSS pension, 13th month, and deadline of pickup of UMID cards. … Read More >SSS Media Advisory

SSS executives lead RACE Op in Taguig City

Delinquent employers given notices of violation by SSS for failing to remit employee contributions and non-production of records.

… Read More >SSS executives lead RACE Op in Taguig City

SSS branches in CAR receive DOH recognition

SSS branches in the Cordillera Region were recently recognized by the Department of Health as Most Distinguished Implementer of RA 10028: Mother-Baby Friendly Workplace … Read More >SSS branches in CAR receive DOH recognition

SSS collaborates with Red Cross Baguio for blood donation campaign

SSS employees came together for a collective blood donation event to commemorate the 66th anniversary of the Philippine Social Security company. … Read More >SSS collaborates with Red Cross Baguio for blood donation campaign