Baguio grants tax waiver to delinquent businesses

BAGUIO CITY – The City Council has approved Ordinance 68-2025, granting a one-time, six-month waiver on surcharges and interest for delinquent business taxpayers with outstanding obligations as of December 31, 2024.

The measure, approved on third and final reading and signed by the mayor on September 26, 2025, aims to help struggling businesses recover from financial setbacks while boosting the city’s revenue collection.

Under the ordinance, business owners with delinquent accounts will receive a 100 percent waiver on surcharges and interest accrued until December 31, 2024, provided they pay the principal tax within the relief period.

The waiver applies only to the principal amount and only during the fixed timeframe.

The tax relief period runs for six months starting September 26, 2025.

Payments may be made in full or through installment arrangements with the City Treasury Office.

Taxpayers who fail to settle their dues within the six-month window will automatically lose the privilege, and all waived interests and surcharges will be reinstated without further notice.

Those who avail of the program will be allowed to renew their business permits and continue operations, as long as they comply with the payment terms.

The ordinance clarifies that the relief does not cover businesses already bound by existing compromise agreements with the city government.

City officials said the program is intended to ease the financial burden on business owners while recovering uncollected revenues that have accumulated over the years.

Share

Related Articles

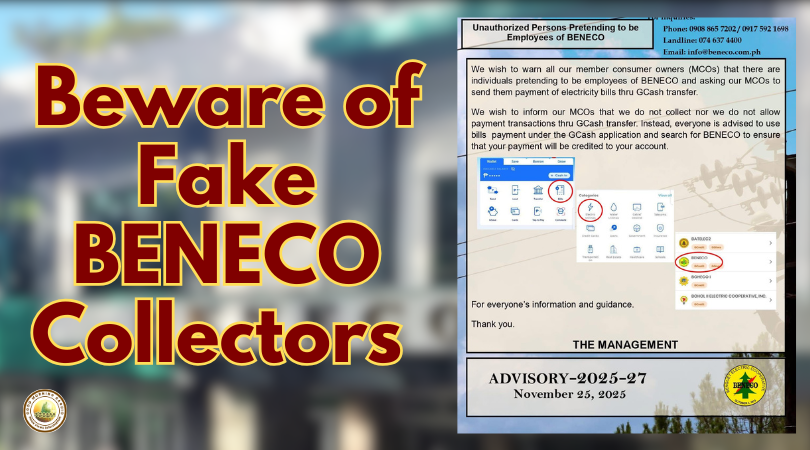

BENECO warns public against GCash payment scammers

BENECO warns consumers against scammers posing as employees and urges members to use only GCash Bills Payment for electricity payments. … Read More >BENECO warns public against GCash payment scammers

BCPO warns public against fundraising and raffle scams

BCPO warns residents to stay vigilant against fraudulent fundraising and raffle scams. Verify permits and report suspicious activities. … Read More >BCPO warns public against fundraising and raffle scams

Recent Posts

- BYD Sealion 5 taxi fleet debuts in Cordillera

- SM City Baguio welcomes Lunar New Year

- 30,000 attend Philippine International Hot Air Balloon Fiesta in Clark

- Cordillera police seize P22.7M drugs, arrest 20 in February crackdown

- Mang Inasal launches TikTok series celebrating Ihaw-Sarap moments

Sections

- Accidents & Emergencies

- Ads & Marketing

- Agriculture

- Anniversaries

- Awards & Recognition

- Baguio's Embrace

- Banking

- Barangay Affairs

- Bazaars

- Business & Economy

- Calligraphy

- Celebrities

- Commercial Developments

- Community Hub

- Concerts

- Consumer Affairs & Entrepreneurship

- Corporate

- Corporate Social REsponsibility

- Creative Economy

- Cycling

- Digital Arts

- Diplomacy & Official Visits

- Diversity & Inclusion

- Education & Youth

- Entertainment

- Environment & Sustainability

- Esports & Streaming

- Events

- Fashion & Beauty

- Festivals

- Film & Media Arts

- Food & Dining

- Golf

- Governance & Policy

- Government & Public Assets

- Health & Wellness

- Holiday Events

- Home & Interior Design

- Indigenous Peoples Affairs

- Infrastructure

- Inspirations

- Jobs & Employment

- Law Enforcement

- Leadership & Appointments

- Legal Affairs

- Legislation

- Literature

- Local Government

- Local Heritage

- Martial Arts

- Milestones

- Mining

- Movies

- Olympics

- Pageants

- People & Personalities

- Performing Arts

- Pertempto

- Poetry

- Politics

- Power & Energy

- Promotions

- Public Health

- Public Safety & Security

- Public Welfare

- Real Estate

- Regional Updates

- Scripture

- Sports

- Technology & Digital Services

- Telecommunications & Digital Policy

- Tennis

- Theatre & Musicals

- Traffic & Transport

- Tributes

- Trustworthy Road

- Urban Development

- Visual Arts

- Weekly Horoscope

- World